Ad

Ad

Will there be a Price Hike in Car Loans with the new RBI policy for the repo rate

Learn how the RBI's repo rate affects car loans in India. Understand the impact of rate changes and make informed borrowing decisions.

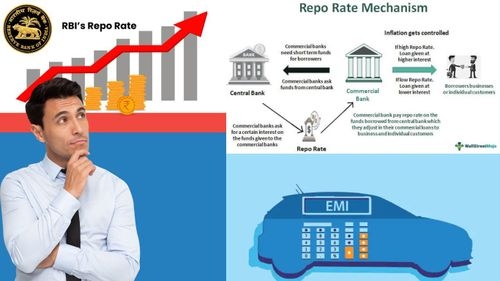

What is Repo Rate?

The repo rate refers to the interest rate at which the central bank, such as the Reserve Bank of India in the case of India, lends funds to commercial banks. This lending is typically done to address any shortfalls in liquidity that commercial banks may be experiencing.

A repo rate is an important tool used by monetary authorities to control inflation in the economy. In cases where inflation is rising, the central bank may choose to increase the repo rate. This increase acts as a disincentive for commercial banks to borrow from the central bank, as the higher interest rate makes borrowing more expensive. This reduction in borrowing ultimately leads to a decrease in the money supply within the economy, helping to slow down inflation.

Conversely, in the event of a decline in inflationary pressures, the central bank may choose to decrease the repo rate. This decrease encourages commercial banks to borrow more funds from the central bank, as borrowing becomes more affordable with lower interest rates. This increased borrowing activity results in a higher money supply in the economy, which can help to stimulate economic growth.

Both the repo rate and reverse repo rate are part of the liquidity adjustment facility. The reverse repo rate is the interest rate at which commercial banks can lend funds to the central bank, and is typically lower than the repo rate. By adjusting both rates, the central bank can influence the liquidity in the market and regulate inflation in the economy.

RBI Policy Repo rate unchanged at 6.5%

"Unprecedented uncertainties in both geopolitics and the economy are currently unfolding before us," stated RBI Governor Shaktikanta Das. However, he emphasized that the RBI will maintain its unwavering focus on the withdrawal of monetary policy accommodation.

Following the monetary policy committee meeting, Das announced on Thursday that the policy repo rate will remain unchanged at 6.5%, with a commitment to take appropriate action if the situation demands it.

Amidst the backdrop of "unprecedented uncertainties in geopolitics and the economy," as stated by the RBI Governor, the Reserve Bank of India has vowed to maintain a steadfast focus on the withdrawal of monetary policy accommodation.

Meanwhile, Governor Das provided some positive news by noting that India's economic activity has displayed impressive resilience, with a predicted real GDP growth rate of 7% for FY 23. In addition, the RBI has marginally adjusted its GDP growth projection for FY 24 to 6.5% from 6.4%, offering further encouragement for India's economic outlook.

In the early hours of trading, the Indian rupee depreciated by 5 paise against the US dollar to reach 81.95 on the interbank foreign exchange. However, the local unit did manage to touch a high of 81.88 against the dollar during the initial trading session. This movement in the currency comes just ahead of the Reserve Bank of India's policy decision.

In the latest meeting of the Monetary Policy Committee held in February, the RBI agreed to increase the repo rate by 25 basis points, bringing it up to 6.5 per cent. Over the last year, starting from May 2022, the RBI has raised the repo rate by a total of 250 basis points.

How Repo Rate can increase the Car Loan?

Ad

Ad

The Indian rupee lost 5 paise to reach 81.95 against the US dollar during early trading on the interbank foreign exchange, just ahead of the Reserve Bank of India's policy decision. Despite the weak start, the local unit did see a high of 81.88 versus the dollar during the first round of trading. The movement of the currency is closely watched by investors, as it reflects the strength of the Indian economy and its trade relations with the US and other countries.

The Reserve Bank of India is the central banking institution of India, responsible for managing monetary policy in the country. One of the key tools used by the RBI to influence the economy is the repo rate. The repo rate is the interest rate at which the RBI lends money to commercial banks, which in turn affects the interest rates that these banks charge their customers for various loans, including car loans.

A repo rate hike can lead to higher borrowing costs for banks, which may then pass on the increased cost to consumers through higher interest rates on loans. This means that car loans, as well as other types of loans such as home loans and personal loans, could become more expensive for consumers. On the other hand, a repo rate cut can result in lower borrowing costs for banks, which could translate into lower interest rates on loans for consumers.

In the case of car loans, a repo rate increase could lead to higher interest rates, which could make it more difficult for consumers to afford car purchases or lead them to opt for cheaper models. A repo rate cut, on the other hand, could make car loans more affordable, potentially increasing demand for cars and stimulating the automotive industry.

Overall, the repo rate has a significant impact on the economy and can influence the availability and affordability of credit for consumers. For those in the market for a car loan, it is important to stay informed about changes

More News

Electric Tata Sierra Seen Testing Ahead of Launch: Details Here

The Tata Sierra EV has been spotted testing again, confirming its electric setup and hinting at steady progress as Tata readies a new mid-size electric SUV.

18-Dec-2025 12:59 PM

Read Full NewsElectric Tata Sierra Seen Testing Ahead of Launch: Details Here

The Tata Sierra EV has been spotted testing again, confirming its electric setup and hinting at steady progress as Tata readies a new mid-size electric SUV.

18-Dec-2025 12:59 PM

Read Full NewsNew Nissan Gravite MPV Teased Ahead of India Launch in Early 2026

Nissan teases the Gravite MPV for India, a practical seven-seater focused on space, flexibility and value, marking a key step in the brand’s 2026 revival plan.

18-Dec-2025 11:49 AM

Read Full NewsNew Nissan Gravite MPV Teased Ahead of India Launch in Early 2026

Nissan teases the Gravite MPV for India, a practical seven-seater focused on space, flexibility and value, marking a key step in the brand’s 2026 revival plan.

18-Dec-2025 11:49 AM

Read Full NewsTriumph Tracker 400 Makes Its Global Debut in the UK: Let's Explore What's New

Triumph unveils the Tracker 400 in the UK, bringing flat-track-inspired styling, familiar 398cc performance and everyday practicality to its expanding entry-level motorcycle lineup.

18-Dec-2025 09:52 AM

Read Full NewsTriumph Tracker 400 Makes Its Global Debut in the UK: Let's Explore What's New

Triumph unveils the Tracker 400 in the UK, bringing flat-track-inspired styling, familiar 398cc performance and everyday practicality to its expanding entry-level motorcycle lineup.

18-Dec-2025 09:52 AM

Read Full News2026 Hyundai Verna Facelift Spotted Testing, Design and Tech Updates: Check Details

Hyundai Verna facelift has been spotted testing under heavy camouflage, hinting at subtle design and feature updates aimed at keeping the midsize sedan fresh and competitive.

18-Dec-2025 06:56 AM

Read Full News2026 Hyundai Verna Facelift Spotted Testing, Design and Tech Updates: Check Details

Hyundai Verna facelift has been spotted testing under heavy camouflage, hinting at subtle design and feature updates aimed at keeping the midsize sedan fresh and competitive.

18-Dec-2025 06:56 AM

Read Full NewsKia India Unleashes 'Inspiring December' Sales Campaign with Benefits Up to Rs 3.65 Lakh

Kia India unleashes 'Inspiring December' with benefits up to Rs 3.65 lakh on top models like Seltos and Sonet. Perfect for year-end upgrades with cash, exchange, and loyalty deals.

17-Dec-2025 11:45 AM

Read Full NewsKia India Unleashes 'Inspiring December' Sales Campaign with Benefits Up to Rs 3.65 Lakh

Kia India unleashes 'Inspiring December' with benefits up to Rs 3.65 lakh on top models like Seltos and Sonet. Perfect for year-end upgrades with cash, exchange, and loyalty deals.

17-Dec-2025 11:45 AM

Read Full NewsCitroen India Has Achieved A Threefold Increase in Sales in Q4 of 2025

Citroën India's Q4 2025 sales tripled vs. Q3, fueled by innovative models and strategic shifts. A game-changer in the competitive auto market.

17-Dec-2025 10:27 AM

Read Full NewsCitroen India Has Achieved A Threefold Increase in Sales in Q4 of 2025

Citroën India's Q4 2025 sales tripled vs. Q3, fueled by innovative models and strategic shifts. A game-changer in the competitive auto market.

17-Dec-2025 10:27 AM

Read Full NewsAd

Ad

Cars In India

MG Hector Plus

₹ 17.29 - 19.49 Lakh

MINI Cooper S Convertible

₹ 58.50 Lakh

Mahindra XEV 9S

₹ 19.95 - 29.45 Lakh

Tata Sierra

₹ 11.49 - 21.29 Lakh

Porsche Cayenne EV

₹ 1.76 - 2.26 Cr

Kia New Seltos

₹ 10.99 - 20.80 Lakh

Mahindra 7XO

₹ 14.00 - 26.00 Lakh

Maruti e Vitara

₹ 20.00 - 25.00 Lakh

Nissan Gravite

₹ 6.20 - 9.00 Lakh

Hyundai Ioniq 5 Facelift

₹ 36.37 - 46.36 Lakh

Ad

Ad

Ad